Capitalism has allowed the citizens of the United States to live better today than any people at any time in human history. The economy of a country is the single most important factor in determining the population’s lifespans, environmental health, the size of the middle class and the degree of social unrest. We would love to make economic predictions with some degree of accuracy. The problem is that the ability to predict the movement of a system is inversely proportional to the number of variables affecting that system, and the number of variables affecting an economy are infinite. The best we can do is develop policies based on observations of what generally increases or stifles growth.

There are two mutually exclusive theories dealing with the government’s proper role in an economy; Keynesian economics and supply side economics. The one our nation adopts will determine whether we continue our prosperity, or if we become another failed grab at a Utopian dream. Democrats such as Wilson, Roosevelt and Obama have generally subscribed to Keynesian theory (JFK being an exception), and their policy decisions have been guided by it. Republicans such as Coolidge, Reagan, Bush and Kennedy (D) generally have supported supply-side.

In 1936 John Maynard Keynes published The General Theory of Employment, Interest and Money. It says that during an economic downturn if the government stokes the demand side of the demand/ supply equation through increased spending, there will be a stimulative effect on the economy. Keynes proposed that this government induced momentum would create a “multiplier effect” (the term he used to describe the process), increasing economic activity, creating jobs and creating wealth. The idea is that the direct recipients of the increased spending will themselves spend more, as will the recipients of their spending etc. The whole idea rests on notion that if by any means consumption is increased, the economy will grow in a sustained way.

Keynes thought that during a recession government should prime the economic pump regardless of where the money gets spent. This idea was stated in the extreme when he said that if the government paid to have dirt moved from one hole to another, the resulting multiplier effect would build economic activity and the economy. Think about what he is saying. The mere expenditure of money will in itself create wealth. In the mid nineteenth century this fallacy was debunked by Frederic Bastiet in his Broken Windows parable. But I digress.

This liberal economic theory is the basis on which Hoover (R) and Roosevelt made most economic decisions trying to get us out of the depression, the theory which Japan has been employing for more than 30 years, and the theory on which the current administration is basing their entire economic policy. They have been trying to spin straw into gold. They will not succeed.

Instead of thinking about supply and demand, think about what really is going on; wealth creation and wealth destruction, better known as consumption. The foundation of supply is wealth creation, just as the foundation of demand is wealth destruction. Wealth creation is the process whereby work, investment, imagination and perhaps a little luck come together to create something of utility that did not exist before. Unlike the physical universe where matter and energy can neither be created nor destroyed, wealth is continuously created and destroyed, or as economists say, consumed.

The purpose of wealth creation is to consume. At a minimum it is necessary to survive. The idea is not pejorative. It is simply a fact. We eat food and it is gone. We drive a car, and after a few years it no longer works. Clothing, housing and most everything has a finite lifespan and must continuously be replaced. Think of what Keynes is proposing in the light of wealth creation and wealth destruction. He says that destroying wealth in any form will create more wealth.

Poker is a zero sum game. Total losses and gains are always equal. If the economy were like poker, society could never advance economically. We would simply be redistributing wealth in different ways, but with no net advance. The good news is that the economy is not a zero sum game, but rather an expanding universe. The most difficult concept to grasp about capitalism and wealth creation (even though it occurs every day right in front of our noses) is that unlike poker, the process really does create things. Something is truly created from nothing. This phenomenon explains how it is possible that many economic transactions profit all the participants; owners, employees, customers and even people on their periphery. Through work and investment wealth is continuously created in every way imaginable. Unlike poker, wealth creation allows for infinitely more winners than losers.

A tree has a certain value. If work is invested and it is harvested and delivered to a mill, because it has more utility than it did as a tree, its value goes up. When the sawmill strips the bark and cuts it into manageable pieces, allowing it to be used for many more things than it did when delivered, the value again increases. And when a carpenter forms those pieces into a chair, he has created even more value. Transporting the chair, advertising it, and retailing it all add value. Should any of these steps be improved on, such as a cheaper way to transport it or advertise it etc, a small bit of more wealth has been created. The retailer, the money provided by the bank to finance all the operations listed above, and many other components all join in so as to create value, aka wealth.

The information age that developed in the last 40 years is a prime example of enormous wealth creation. When compared with the present day, communications devices hardly existed 100 years ago. Those that did were crude by today’s standards. Modern devices have created untold trillions in wealth. Mankind has taken grains of sand and created silicon chips, on which inconceivable amounts of information are stored and accessed by millions. Calculations that were unimaginable 20 years ago are done in milliseconds. Exponentially more information is available instantly on your cell phone than was available 20 years ago in all the libraries in the world combined. Voice communications go around the world, cost pennies, and do it with an ease that nobody thought possible until recently. The benefits of this extend into almost every facet of business and our personal lives. New drugs, new airplane designs, and much more can be modeled on computers which allow development to take place in a fraction of the time, at a fraction of the cost, and far more safely than just a few years ago.

Throughout history society has learned more and more about this process, and the rate of wealth creation has increased far faster than society’s ability to consume it. Advances in one field allow for others to piggy back on the new found knowledge and accelerate their own advancement. This has yielded exponential growth, and it continues accelerating today at a record pace. Over 25% of the goods and services that have been created in the history of the world have been created in the last decade. Many scientists claim that scientific information, which oftentimes translates into wealth, is doubling every decade. Think of that. In the next 10 years we will learn twice what was known in all of science in 2010, 4 times what was known in 2000, and 8 times what was known in 1990. All of it serves as a spring board to better, longer, more bountiful lives, at least in a material sense.

To understand the effects of wealth creation think of Microsoft. Bill Gates and his employees made vast amounts of money for themselves and their shareholders. In addition his products enabled businesses to provide new and better products and services thus creating far greater wealth than they ever could have without Microsoft, benefiting every consumer alive. Think about Walmart. It is the largest most profitable retailer in the world. A family of four earning $60,000 per year that lives near a Walmart will save about $2,500 per year when compared to a similar family not having one of their stores available. Walmart’s efficiencies and expertise create wealth for everyone; shareholders, employees and their customers. Contrary to liberal economic thinking, Henry Ford had it right when he said that a man gets rich thinking how much he can give for a dollar, not how little. Walmart’s success puts money in everyone’s pockets. Almost all successful companies create wealth for everyone. The total amount of money that shareholders and employees at Microsoft and Walmart made is minuscule when compared to the wealth that other businesses and the public enjoyed because of them. And that is the magic of capitalism.

Growth in a society requires security, protection of private property, a court system, roads, etc. Those and certain other government functions are the infrastructure that allows wealth creation to occur, and in a broad sense they can be conceived of as wealth creation. However, as necessary and valuable as they are, they make up only a tiny percentage of overall government expenditures. Welfare, Medicare, Social Security, and the EPA, are all agencies designed to consume. I am not being critical if as a society we choose to spend money on them, although I would point out the cost of government doing them is far greater than if they were done by the private sector. The debate here is not what government should or should not provide, but whether or not those expenditures or additional government spending has a positive effect on the economy.

When the government spends it claims to increase economic activity. Their spending not only does not stimulate growth, but actually retards it. The government creates only negligible wealth. It mostly redistributes money and a consumes a great deal in the process. The money the government spends can only come from two places, taxing or borrowing from the private sector. The same dollar can’t be spent twice. Whether a dollar is consumed by the government or invested by the private sector, Keynes’s imagined multiplier effect created by spending that tax dollar is the same (government versus the private sector spending it).

There is one notable difference. Although a dollar in the governments hands only gets consumed, in the private sector that dollar will be partly consumed, and partly invested in an attempt to create more wealth. Work and investment are the sources of wealth creation. Money is stored and transferable work. Investment is the transfer of work (money) in order to create wealth. I submit that an invested dollar has a dramatically different and far more positive effect on the economy than does a consumed dollar. Investment (stored work) is trying to create more wealth than what it is consuming in the process. Work (investment) is the only means of creating the goods and services needed for consumption, thus it is the only thing that creates economic activity. Consumption does no such thing. Baking a pie increases economic activity, not eating it. Keynes and his multiplier effect suggest the economy is some kind of perpetual motion machine. There is plenty of heat and light given off from a bulb so long as the electricity is on. But turn the power off and the heat and light stop.

Of course many attempts at wealth creation fail and end up becoming wealth destruction. Investments often turn sour and become worthless. But history has shown that the value of the successes dwarfs the combined losses from the failures. Suppose there were a million failed attempts at designing a hammer before one succeeded? Wouldn’t that single success create millions even trillions more times the wealth than the total of the failed attempts destroyed? There are few if any changes in science, commercial development or anything that have not been built on the knowledge gained from previous failures. Still, immeasurably more wealth gets created than all the losses combined. And heretofore this has been accomplished in spite of the foolishly destructive economic restraints imposed by governments that simply don’t understand.

Since taxes are the main source of revenue for increased government spending, particularly stimulus spending, one must ask what the effect of higher taxes is on corporations and individuals. Increasing taxes on consumption or investment takes money from the private sector, although taxing consumption has a smaller negative effect on the economy than taxing investment. Investment taxes takes money away from wealth creation and everyone loses. The individual or corporation being taxed obviously loses, but the public and the government itself gets less money. Raising taxes on investment may raise revenue in the short term, but because it reduces investment (wealth creation), in the long term it cuts consumption and growth, and therefore reduces revenue. The seedlings of investment never get planted. If revenue for the government were raised only from consumption (not investment), and the less the better, we would all be richer. The government would be much fatter with one quarter of a sixteen inch pie rather than an entire six inch pie.

The wealthy only have three things they can do with their money; consume it, invest it, or donate it to charity. I would argue that although charity is wonderful and often helpful, it can be an inefficient use of money, and worse, it can be a destructive force (see The Ford Foundation and The Pew Foundation for details.) But that discussion is for another day. For my purposes here, I have limited the discussion to two choices, consuming and investing. The truly wealthy in America could not consume all their wealth if they tried. No matter how ostentatious they may be, they simply have too much money to spend it all. Because of this, they must invest, and that is a blessing to us all.

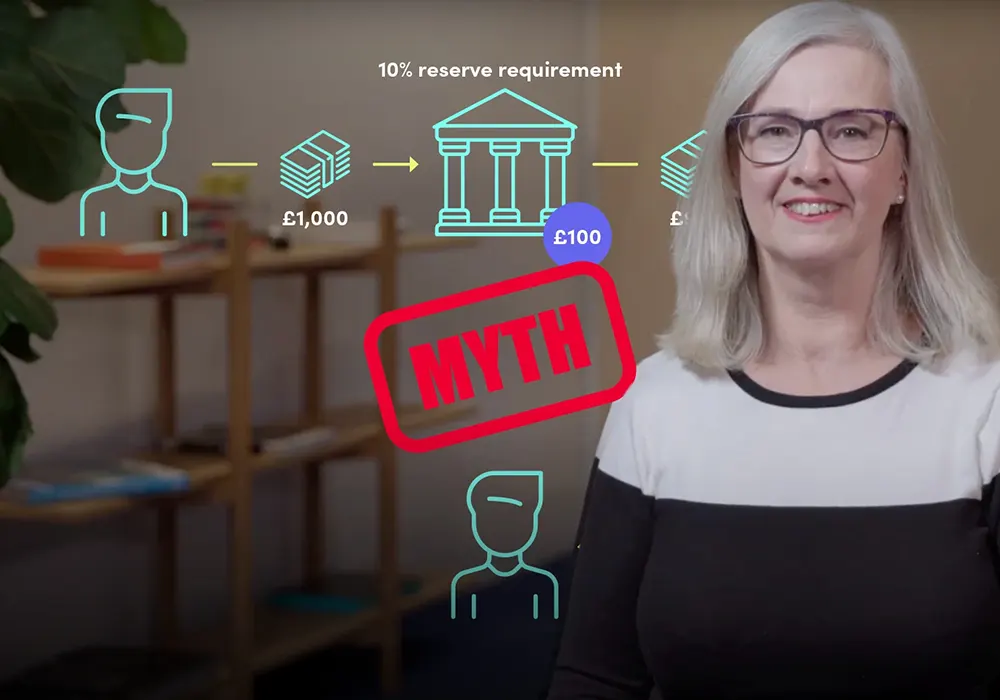

One liberal argument is that saving is neither consumption nor investment, and that it creates no economic activity. They couldn’t be more wrong. Unless savings are in the form of putting one’s money under a mattress, ultimately all savings get invested in an attempt to create wealth. Trace the “safest” of savings devices, US government insured savings accounts. If one deposits money in a bank, the bank adds about ten percent of its own cash to the amount deposited, and lends that entire amount out at a higher interest rate than it is paying to the depositor. That is how it makes money. Some borrowers use the money for consumption, but many use it to finance business and investment, aka create wealth. The point is that even money in pass book savings accounts finds its way into investment.

Liberal economists argue that the rich can afford more taxes and must “pay their fair share,” as if this is an ethics debate. They point to increasing income disparity, saying the rich should “give back.” It is true that the rich can better afford increased taxes, but it is the middle and lower classes that can not afford to have the rich taxed more. We can not afford to strip these job and wealth creators of much needed capital. I for one could care less about the motives of the rich. It could be greed, self aggrandizement or anything else. Neither can we afford to strip them of incentives. The effect of their investment benefits us all. Some people are willing to work for nothing, but I wouldn’t want to bet everyone’s economic future on it. I can’t remember which great American said this but it is ever so true that, the brewer, the butcher and the baker sell food not for your survival, but for their own.

This whole liberal notion of fairness is dangerous and destructive. It undermines the very goals we all seek to achieve. What is fair about bringing income levels closer together if doing so demands that everyone, especially the poor and middle class, lower their standard of living? JFK said he was cutting taxes on the rich because, “A rising tide raises all ships.” He was right. Helping the poor is a laudable goal, and if they are to be helped there are only two possibilities. The rich will get richer as the poor get richer, or everyone will go down hill together. History teaches us there is no third way.

In the US every time taxes were reduced total tax revenues to the government increased. This happened under Coolidge, Kennedy, Reagan and Bush. Every time taxes on the rich were reduced, the rich paid more total tax dollars, and they paid a higher percentage of the total tax revenue. Which is better; having higher taxes with fewer jobs and less money coming into the government, or increasing jobs and revenue with lower taxes? Which is better; having the government tax and borrow money, distributing a small portion of the receipts while eating up the rest in the bureaucracy, or having that money used to let the job creators and producers do what they do best?

I can not find one historical example where government spending helped any economy. It has been tried in the US, Europe and Japan, and growth was anemic when measured against those times taxes were reduced without stimulus spending. After the Japanese market crash in the late ’80s (the market lost 75% of its value), the country tried stimulus..and they tried again..and they tried again..and is still being tried today. Yet the economy has not grown. There has been no job creation and no increase in wages. The only discernible change is what always happens when stimulus is tried. They ran up the national debt to 240% of GDP.

Supporters of Keynes’s theory generally credit the highest government spending in US history, that which resulted from World War II, with the post war expansion (1945- 1973) and our emergence from the Great Depression. The commonly accepted story of this and the depression are seriously at odds with the facts surrounding them.

The Cliff Notes version of the depression starts with Woodrow Wilson. When the 16th amendment was passed in 1913 (authorizing the federal government to collect income tax) politicians said the top tax rate would never go above 7 percent. By the end of Wilson’s term 7 years later it was at 77 percent. In 1917 we entered WWI (30 days after Wilson was re-elected on a promise to keep us out of the war). The war, tax increases and other redistributive, anti business policies led to a near depression in 1920. When Wilson left office the economy had shrunk by 25 percent, government debt had skyrocketed (in part due to WWI, but not all), and unemployment was at 20 percent.

In 1920 President Harding (and then Vice President Coolidge who assumed the Presidency when Harding died shortly after taking office) lowered government spending by 50 percent over 8 years. Think about that when today’s politicians tell us that one percent cuts would be draconian. Coolidge began a series of tax reductions unprecedented in US history. In 1928 when he left office, he had lowered the top rate from 77 to 20 percent, but more impressive is that the top rate was paid by only 2% of Americans. Let me repeat that. Only 2 percent of Americans paid the top 20% rate. When he left office unemployment was the lowest in American history, one half of one percent. It had averaged 3.3 percent during his eight years, dropping from 20 percent when he entered the office. After unwinding much of the pro union legislation, real wages went up at an unprecedented rate across the board. Revenue to the government skyrocketed and the national debt was reduced by one third. Needless to say economic growth was record setting. The nominal growth may not have looked very impressive, but that is because there was so little inflation. Real growth (nominal growth minus inflation) was spectacular.

A more accurate history of the depression is that the Hoover’s and then Roosevelt’s attempts to bring us out of what would probably have been no more than a severe economic downturn, actually exacerbated the problems created by the1929 stock market crash. They turned a recession into a the great depression, and the country mired in it for over a decade. In part the 1929 stock market crash occurred because of central banks around the world providing easy money (known in the US as an accommodative fed policy). That and the market bubble created by the euphoria of the exceptionally strong economy in the roaring 20s both played a part. In those days bank policy allowed 10 times leverage on stock purchases. Investors needed $100 to buy $1,000 worth of stock. People were betting 10 times their entire worth on the market. When stock prices declined, this leverage forced massive selling, which in turn drove the market down farther, causing even more severe price declines. In a free market bubbles occur, and they burst. But if policy makers leave the economy to its own devices, it always heals itself and grows beyond the last high point it achieved. It never fails however that when politicians intervene, the healing process is extended well beyond what it otherwise might have been, just as our current President’s ill-advised policies are extending the time to recover from the housing crash.

After the ’29 crash unemployment jumped from near zero to 15%, and the economy began to shrink quickly. It took a little over a year for the first legislation designed to “help” the economy to get passed. During that year, the pre-legislation period, when things were able to heal on their own with no “help” from the government, the economy began to grow and unemployment came down to 9%. When the “help” from the Hoover administration arrived, (for example The Smoot Hawley Tariff Act which imposed tariffs on imports sparking a world wide trade war) everything went to pieces, unemployment jumped past 20% and the economy began to shrink. The policies of first Hoover and then Roosevelt in 1932 (higher taxes, more spending, protectionism) kept a boot heel on the neck of the economy, preventing any type of resuscitation until after WWII.

Keynes type stimulus was tried repeatedly between 1929 and 1940 and it failed miserably. Henry Morgenthau, Roosevelt’s Treasury Secretary, famously said, “We have tried spending money. We are spending more than we have ever spent before and it does not work. After eight years of this administration we have just as much unemployment as when we started, and an enormous debt to boot!” Those who believe in Keynes theory also fail to acknowledge our post war emergence from the Depression included large tax and spending cuts along with massive deregulation in 1946 and 1948. We supply-siders would argue that was the real engine of growth. Truman’s spending/ stimulus plan was rejected and replaced with what we now call supply-side incentives; lower taxes, lower regulation and lower government spending.

Keynes supporters and liberal economists often point to Bill Clinton’s tax increases in 1993 and the following economic expansion as a successful example of applied liberal economic theory (spell that tax increases and spending increases). I would argue that the income tax increases probably hurt the economy, but they were dwarfed by other positive factors introduced under Clinton. He signed a capital gains tax cut into law, a far more important tax on investment than the earned income tax that went up. He signed the North American Free Trade Agreement into law, creating a massive increase in trade. Along with congress he cut government spending (not increases as Keynes might have liked) eventually balancing the budget. And lest we forget one of the largest wealth creation events in history occurred on his watch, the internet explosion, which is the bridge that is taking us from the industrial age to the information age, fundamentally transforming the entire world’s economy. The tax increase impact was minuscule compared with these accomplishments.

Another argument liberal economists make is that tax cuts will “blow a hole in the budget.” Their claim, is based on CBO (Congressional Budget Office) estimates, which say that the permanent extension of the Bush tax cuts would cost the government 3.7 trillion dollars over 10 years. This is wrong on so many fronts it’s hard to decide where to begin.

The CBO estimates are most often way off because they are made with a legislatively mandated method of calculation. It assumes a patently false premise; that people don’t change their behavior with changing tax rates, as if we will all make the same investments, take profits and losses at the same time, and act in the same manner no matter whether rates are 20% or 70%. An extreme example of this delusional thinking is the luxury boat tax in 1990. It imposed a 10% tax on all boats costing over $100,000. The CBO projected a huge tax revenue increase based on 10% of the prior years boat sales. They were 180 degrees off the mark. People simply stopped buying boats. When the dust settled, the government collected tens of millions less than the CBO estimate, 100 boat manufactures went out of business (about 75% of them), 25,000 boat industry jobs were lost, and an additional 75,000 other jobs were estimated to have been lost as a result of the industry decline. The CBO is a political tool allowing politicians to make ridiculous statements under the false banner of something official and nonpartisan.

The language used in the debate favors the Keynesians because we supply-siders often fail to point out the false assumptions embedded in many of their assertions. Words like stakeholders imply that the consumer is somehow a part of the production process, and has rights because of it. They have the right to expect truthfulness about the product, product safety, and that environmental and other laws be complied with. But they are not entitled to make business decisions for the company or co-opt the wealth the company creates. All manner of wealth transfers occur under the compassionate sounding euphemism of social justice, moving money from producers to consumers. Real social justice, something that really benefits everyone, is respect for private property, the oxygen that allows capitalism to provide the most bountiful material harvests ever known to mankind.

It is clear that if you want less of something, tax it. More taxes on wealth mean less wealth for everyone. When the Democrats say that Republicans want tax cuts for the rich and rich corporations, and it would “punch a hole in the budget,” the Republicans should answer yes they certainly do want the cuts. They want them because the economy will expand, increasing tax revenue. They want lower taxes because they want more jobs and higher wages, and lower taxes (especially for the rich) mean people will invest money doing exactly that. High tax and spend governments simply choose which non producers should consume the fruits borne of the real producers efforts. Not surprisingly, the recipients of this largess are usually groups that benefit political decision makers.

The Keynesians and their followers (main stream media for one) love to assert that “everyone agrees” that cutting spending during a recession is a recipe for disaster. No, everyone does not agree. In fact I would argue that among the people who have no political interests to serve, the overwhelming majority disagree. Margret Thacher cut spending to the bone (and taxes) during one of the worst recessions Great Britain ever endured, and when the dust settled the country enjoyed the greatest economic expansion in their history. Pinochet did it in Chile during one of the most successful economic transitions in history. Coolidge also did it with phenomenal results, and there are numerous other examples. History shows that over time, reduced government spending may initially reduce economic activity, there may be some pain, but shortly after the economy blossoms, increasing economic activity, jobs, and wealth.

Currently the Europeans are cutting spending and increasing taxes on a discredited theory that this will reduce the size of government and increase revenue at the same time. This will not work. They have their foot on the accelerator (spending cuts) and the brake (tax increases) at the same time. Cutting both is needed.

John F Kennedy was a committed supply-sider. One of his signature achievements has all but been written out of the history books (academics are generally liberal and since the facts here contradict their economic theories/ bias they simply ignore them). About a month after his death the tax plan he had promoted for a year got enacted. It quickly produced jobs and wealth just as he predicted. Here are a couple of his numerous quotes on the subject.

“In short, it is a paradoxical truth that … the soundest way to raise the revenues in the long run is to cut the (tax) rates now. The experience of a number of European countries and Japan have borne this out. This country’s own experience with tax reduction in 1954 has borne this out. And the reason is that only full employment can balance the budget, and tax reduction can pave the way to that employment. The purpose of cutting taxes now is not to incur a budget deficit, but to achieve the more prosperous, expanding economy which can bring a budget surplus.”

– John F. Kennedy, Nov. 20, 1962, news conference

“The largest single barrier to full employment of our manpower and resources and to a higher rate of economic growth is the unrealistically heavy drag of federal income taxes on private purchasing power, initiative and incentive.”

– John F. Kennedy, Jan. 24, 1963, special message to Congress on tax reduction and reform

Up until now I have tried to contain at least some of my considerable bias. But I really think that Keynes theory has as much validity and makes about as much sense as a perpetual motion machine. It reminds me of the joke about a businessman who would buy watermelons for $3 and sell them for $2, but figured he could make up for the loss with more volume. Winston Churchill said, “We contend that for a nation to try to tax itself into prosperity is like a man standing in a bucket and trying to lift himself up by the handle.” Isn’t that exactly what Keynes has proposed? He is saying the more we consume, no matter how wasteful, the more wealth we will have to consume. This is bizarre at best. Yet in the face of repeated and consistent failures, our politicians continue to appropriate money for just such folly.

Of course Keynes is not alone in developing crackpot economic theories. One seemingly everlasting fiction is that minimum wage increases help people earn more. Not only does it make no sense (if it had merit we should raise everyone’s wages to $1,000 per hour, or better yet, $10,000 per hour), but the history of implementing minimum wages has always resulted in the loss of jobs, productivity, and thus wealth.

Another continuously repeated foolishness is the hubris that government can control inflation with wage and price controls. Nixon and Carter tried to employ this nonsense. It resulted in an entire dislocation of economic forces giving us some of the highest inflation in our history and one of the severest recessions. Obama is trying the same failed approach with the health care bill through government imposed prices and regulations, and with the financial regulation bill, mandating what banks can and can not charge. I can’t be sure exactly how this will play out, but I am certain it will end badly . It always does. Who would have thought that mandating gasoline be 10% corn based ethanol would cause food inflation in Mexico, but it did.

Some results of government tampering are easily predictable. What makes it frightening is that often times failure is obvious to everyone except those making the decisions. For anyone who doesn’t realize that taking away someone’s incentive to work will result in their not working, we now have almost 50 years of history proving it. In this land of plenty there are 4th generation welfare recipients. If your mother and grandmother were on welfare, and that was the only universe you were exposed to, what chance would you have of even seeking much less finding gainful employment? Welfare does not serve the poor. It is an economic and spiritual maximum security prison from which few ever escape.

Finland used to give 5 years of unemployment benefits. They lowered it to 4, and then 2. They found that the shorter the benefit time the faster people found work. Is that a surprise? People will focus and compromise a lot more when they face an uncertain future. Roosevelt began unemployment benefits with 16 weeks worth. Obama has increased it from 6 months to 2 years, prolonging this economic agony.

Congress gave money to homeowners who are underwater with their mortgage in an attempt to bail them out. The result after spending billions; most re-defaulted. The worse part is that until a bottom to the housing market is reached, no new construction/ job creation/ wealth creation in that industry can begin. In their infinite wisdom congress has delayed the market from reaching bottom, and thus delayed the recovery. It was clear to anyone paying attention that this would happen, but congress proceeded anyway.

Politicians were positively giddy at the “success” of the “Cash For Clunkers” program. They congratulated one another claiming the success was beyond their wildest dreams. What happened? The government said that if you owned an old junk car, and if you traded it in on a new car, they would buy the junker from you at somewhere between 2 and 20 times its market value (up to $5,000). No surprise, people took them up on it. Inducing people into selling their car for much more than it is worth seems like a no brainer to me, but in Washington it is called an astonishing success. And for the record, new car sales slumped below average as soon as the program ended. All Congress succeeded in was moving some new car sales forward in time, but not increasing total sales at all. Of course they gave away billions of taxpayer money in the process.

At the beginning of this I said you would decide. It is now time. If I have been convincing, don’t allow someone’s scholarly credentials or someone’s false assertions to sway you. For decades academia has been singing the praises of this false god, Keynes. Everyone has an agenda, everyone has a bias, myself included. Therefore, your best defense against being misled is to apply your life’s experiences and a good dose of common sense to the facts, and then decide.

Ronald Reagan said most of the answers are simple, they’re just not easy. This is one of the simple ones, but it will still be difficult to sell and then implement.